Platform

The business challenge

TSB's current market share among customers under the age of 19 stands at 2% in the UK. This project explores how directional research and design sprints can identify and define an attractive 16-18 value proposition, with features and benefits that meet Gen Z's needs at the various stages through to adulthood.

Business problem:

TSB is seeing a decline in main banker population.

Objectives:

-

Grow adult main banker population by onboarding more 16-18 year olds.

-

Define an attractive proposition for 16-18 year olds.

-

Keep 16-18 engaged and 'Super Active' to maintain them into adult main banker population.

Design process

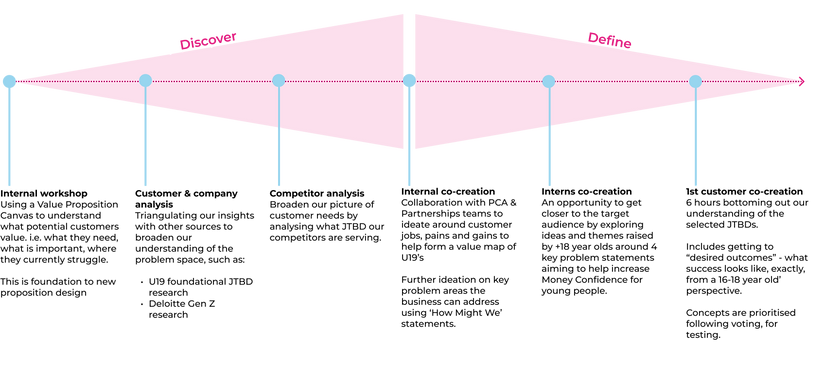

Embarking on my UX design project, I harnessed the power of the Double Diamond design process—an iterative framework that guided every phase of ideation, defining, prototyping, and testing. This approach allowed for a systematic exploration of diverse solutions, ensuring a thorough understanding of user needs and delivering a finely tuned and user-centric final product.

Defining the problem

In the initial phase of the Double Diamond design process, the "Discover & Define" stage, I engaged in a comprehensive exploration that encompassed internal workshops, customer and company analysis, competitor analysis, as well as internal and customer co-creation sessions. This immersive investigative process laid the groundwork for a robust understanding of user needs.

Understanding the landscape with research and data

Company research

Analysis of company data, U19 customer segment including digital engagement, account activity and longer-term value.

Between:

-

eBenchmarkers

-

PCA data

-

Strategic Insights

-

CX & Innovation

Customer research

Analysis of target customer group in:

-

Foundational Manyone JTBD research

-

Deloitte Gen-Z study

-

Youth, parent and partnership

-

LadNation quant study

Competitor research

Delving into the youth banking experience, analysing key competitors looking at features, products, benefits and all round propositions.

Building hypotheses, understanding and concepts with customer insight

Internal co-creation

We worked in collaboratively with personal banking and partnerships teams to ideate customer jobs, pains and gains to help form a value map for U19s.

Interns co-creation

We saw this as an opportunity to speak to people who are much closer to the 16-18 demographic than us!

-

Crazy 8s exercise

-

Understand user pain points

-

understand user banking

habits

16-18 co-creations

We now have a clear picture of what we think 16-18s would value, but we also spoke to them directly to generate ideas and validate our assumptions.

-

Crazy 8s exercise on specific 'how might we' problem statements

-

Refine concepts

-

Understanding participants attitudes across key financial aspects

Value hypothesis

We started with a long list of assumptions, based on research and co-creations of ideas with internal stakeholders and TSB interns and aligned these to TSB's strategic four steps of money confidence - Understand, Control, Stretch and Empower.

Then we prioritised that list to ones we thought were most valuable -

The four steps of money confidence aligned nicely our hypothesis and allowed us to develop assumptions that follow, evolve and grow as the young person does -

Understand

Product Engagement

We believe that young people aged between 16 to 18 will value finding out about youth accounts and or features advertised on TikTok instead of other social media platforms, such as Instagram/ Facebook

Effective marketing

We believe that young people aged between 16 to 18 are more likely to value the advice of people like themselves (fin-influencers) instead

of people of authority (TSB MCE) on social media

Financial education

We believe that young people aged between 16 to 18 will value a youth account that helps them learn about practical financial tips and tricks to help manage their money

Control

Open banking - Hygiene app features

We believe that young people aged between 16 to 18 would value getting a better picture of their money and spending by sharing their financial data with other banks

Your money

We believe that young people aged between 16 to 18 would value a youth account that helps them understand the impact of their spending

Independence

Young people aged between 16 to 18 would value a level of independence around their finances without bombarding parents but with the ability to have their support when needed

Stretch

Rewards & partnerships

Young people aged between 16 to 18 will value repeat rewards (e.g. retail) instead of one off experience days out

Rewards & partnerships

Young people aged between 16 to 18 will value rewards closely linked to a particular moment in life e.g. free driving lesson when you turn 17 (birthdays etc)

Budgeting 7 saving

Young people aged between 16 to 18 would value an account that will help them save for their long term goals

Empower

Build credit score

We believe that young people aged between 16 to 18 would value a youth account that helps them to proactively build their credit history before the age of 18 (before adulthood )

Key life moments

We believe that young people aged between 16 to 18 will value a youth account that helps them to learn about practical life hacks so they can step into adulthood more confidently e.g.:

-General living costs (bills & utilities)

-Moving out

-First job

-Student life - Loans - Where to spend/ where not to spend

.png)

.png)

Define the solution

TSB wants to increase their super active/main banker population. Targeting under 19's supports this ambition, with 20% of super active account holders joining TSB before they were 19.

Validating hypotheses and concepts with target audience

Design sprints

Synthesised all the concepts and put them into prototypes.

Aligned them with our 4 steps to money confidence:

1. Understand

2. Control

3. Stretch

4. Empower

User testing

Moderated user testing to understand users thoughts on proposed proposition.

-

Aged 16-18

-

Further understand the participants banking universe

-

Rating on uselessness and likelihood to use, and then ranking them against each feature.

16-18 show and tell

Now we have tested and ranked the concepts, we had another opportunity to speak to youths in order to refine the proposition and gather more insights into areas that need further exploration.

-

Deep dive into financial learning topics of interest & social media usage

-

Understand what partnerships user would most value

Design sprints

We then synthesised ideas from all co-creations into a master set of features to test with users. Keeping the four steps of money confidence in mind - understanding, stretching, control, and empowerment, with a particular emphasis on fostering growth. These integral stages served as the foundation for developing an experience that not only imparts essential financial knowledge but also empowers young users with the confidence to navigate their finances effectively and facilitate their financial growth.

Understand

Unleashing financial wisdom together

Learn from peers on key financial topics through a TSB TikTok page

Learn and Earn

Interactive quizzes, challenges and situations - and get rewarded with partnership others

Speak to us

Organise a videocall, branch visit or join a webinar to talk through key question you may have

Expert in your pocket

Use chatbot to answer key questions you may have

School workshops

Workshop in school around 4 key topics

Control

Income splitter

Automatically split income into needs/wants/savings pot according to budget

Spending limits

Limit spending per category

Weight of money

Making the spender reconsider splashing out unnecessarily with extra friction

Insights

Historical view on where your money has gone each month, over categories and merchants

Shared reports

Sharing your progress with savings, or spending with a parent and having the ability to receive a 'top-up' or gift card reward

Stretch

A pot for anything

Savings pots, but positioned as money management tools

Your pots, your way

Saving pots with a few extra features, like locking, hiding, interest and transfers

Top me up

Allowing friends or family to add to a pot with a personalised message

Compete with friends

Adding a competitive element to saving

Rewards along the way

Rewarding progress with gamification/rewards on the way to a larger goal

Unlock virtual cards

A card that only spends from a specific pot and leaves your main money untouched

Empower

Lifehacks just for you

Articles on key financial topics, to young people's life stages

Unlock features as you get older

An account that changes as young people move through key life stages i.e. uni, first job, moving out

Celebrating key milestones with you

An account that recognises and celebrates key milestones with relevant rewards

Job hunting made easy

Partnering with career services, opportunities for internships and CV/interview advice

Speak to an expert

Opportunities to speak to TSB about key life stages

Concept testing

How the features stack up - The ideas from the user testing were ranked within their respective Money Confidence pillar. The best and brightest were brought forward in the final co-creation sessions and then ranked again.

.png)

.png)

.png)

.png)

.png)

.png)

Findings

The research findings provided comprehensive insights and a robust foundation for informed decision-making

Insight #1

16-18 year olds are more than likely to have joined the bank their parents have at a young age

9 in 10 had input from family members when choosing their first bank account with 39%, the reason, joining the bank their parents have. [Lad Nation]

-

The parents' choice is driven by comfort, not by evaluation. With most parents opt for familiarity and trust of their own bank. [Manyone]

-

This is often because it is the easiest way to onboard, although with branch closures (60% of network) people are seeking the next easiest onboarding - digital or the next nearest bank.

-

27 out of 29 co-creation participants said their parents set up/opened their bank account. [Co-creation]

Most 16-21 year olds have only one account but this changes as their needs evolve.

-

77% of 16-17 year olds and 63% of 18-21 year olds only have one account. [Lad Nation]

-

34% of 16-21 year olds move onto alternative banks when their needs evolve, like having a side hustle or looking for better PFM tools (savings, pots, cypto, or better (faster) payments) their main bank doesn't offer. [LadNation & Manyone]

76% of youth accounts are opened before they are 17, with 70% of 18-21 year olds still using the account they used at 16 and 17 years old.

-

Communicating benefits of bank account prior to that age may be key in decision making, espeically as they tend to keep using this account into early adulthood. [LadNation]

Insight #2

Needs evolve and become more complex as they get older - jobs, cars, university & life in general

Child accounts can be a runway to long term financial relationship, or a dead end [Manyone].

-

Needs change significantly between 16-18 and their banking behaviours reflect that their bank account needs evolve with their changing needs, with significantly more 18-20 year olds (34%) having second accounts than 16-17 year olds (10%) [LadNation].

-

Neo banks are a popular second account choice, providing the utility their main bank doesn't, and also onboard easily [Manyone].

U19s enter the banking world under prepared and not ready to manage to manage their money.

-

Young people do not feel prepared enough when they learn about money management [Manyone], with 39% of 16-17 year olds surveyed saying they don't think about finances yet as it's too complicated.

-

Child bank account make them feel like adults, however they don't empower them to learn how to manage money [Manyone].

Recongnising key milestones otnes could create positive brand perceptions.

-

Rewards that help individuals reach a life milestone was most desired (e.g. free driving lessons) by 16-17 year olds [LadNation].

-

Education, birthdays, and driving were chosen as the top three moments young people would like their bank to recognise [Youth design sprint].

Insight #3

There's a feeling of uncertainty about the financial future and a desire to know the right things

TikTok is a growing source of financial advice

-

Over 1/3 of 16-17 year olds say they would go to TikTok for financial advice [LadNation].

-

Final decisions still come through more trusted channels (internet search 52%), especially family members who this audience trusts (72%), so building a narrative using combinations of these sources will be most effective [LadNation].

Young adults want to be in the know about their finances and living costs, but some don't know where to start

-

'Learn financial tips and tricks to help manage my finances from my account provider' was ranked as the first most important feature by 16-17 year olds and 18-21 year olds (when asked to reflect on being 16-17) [LadNation].

-

Young people do not feel prepared enough when they learn about money management and banks could seize this opportunity to support their financial literacy education [Manyone].

Financial advice needs to be relatable and contextual for it to be meaningful

-

When seeking advice on financial literacy knowledge trumps age. Ideally, from authentic, trustworthy and relatable people that add to their experience, MCE and independent money expert coming out tops and influencer bottom in our co-creation activities. Participant quote: "I care about knowledge and expertise not age" [Co-creation].

-

Advice is wanted from someone relatable and personable with evident experience [LadNation].

Insight #4

Youth find it hard to control their spending, and would welcome Personal Financial Management (PFM) tools to help

There is a desire to exercise better control over their finances, specifically around budgeting.

-

Youth are confident in saving and would do so if they were better at managing their finances [Co-creation].

-

Banking features that support saving, budgeting and managing money were most important for 16-18 year olds [LadNation, user testing & co-creation].

Overspending is viewed as an issues with contactless and Apple/Google Pay being a contributing factor to youth just 'tapping until my account is empty'.

-

52% of 16 - 17 year old and 73% of 18 - 21 year olds use mobile payments such as Apple/Google Pay daily/weekly [LadNation].

-

Almost all co-creation participants (7 out of 9) use Apple/Google Pay regularly.

Being able to partition their money to give themselves permission to spend on the 'stupid stuff' an important idea, which is why Saving Posts and Income Splitter ranked so highly.

-

Youth rank features that help them set goals for saving and tips on how to acheive goals highly [LadNation].

Insight #5

Rewards, even something small, is appreciated when tied to building good habits.

Rewards encourage when they are relevant: Cash top up was the most popular reward choice as it is an ultimate flexible reward that can be used however people want it.

-

6 out of 9 co-creation participants voted 'Cash Top-up' as the most preferred reward type.

-

Empowering young people to choose how to spend rewards could be encouraging. Co-creation participant quote for cash top up: 'Can use on anything"

Cash top up credits that boost savings could motivate young people to save more

-

Cash top up when saving goals have been met could be motivational [Co-creation]

There isn't a specific type of reward (discount, brand or offer) that is a clear favourite, but small freebies were viewed positively (i.e. a free coffee).

-

Our research shows that every customer is an individual and has their own idea of what a good reward looks like, however participants of our 2nd co-creation did highlight that getting something small like a coffee can be viewed more positively then getting a discount on something bigger that you will still need to contribute to.

-

The absence of a preferred reward was also hgihlighted in our Lad Nation survey, where the top four reward options preferred by 16-17 year olds yeilded very similar results [LadNation].

Recommendations

Taking into consideration the findings, the following recommendations were made.

Recommendation #1

Market directly to parents, and reduce friction in onboarding (time or effort required)

1. Reduce time and effort to open an account to maximise the chances of capturing the youth audience.

2. Offer a digital solution, in the first instance an app journey, or alternatively a video banking solution using Adobe Forms to reduce the 60-90 minute wait time. Back office staff can key in details to the clunky Proteo system afterwards.

3. When opening a child's account, the needs are not very complex, often it's just a place for money in/ money out, and potentially a child savings account.

Recommendation #2

Recognise key life moments, even with a simple notification. Offer guides or help for their next life stage (i.e. savings pot for car/holiday)

1. A simple 'Happy Birthday' message can do a lot for brand awareness. In app prompt or notification that celebrates key events for U19 e.g. 17th birthday, exam session, start of university.

2. Recognise moments with rewards e.g. discounts off driving lessons when you turn 17.

3. Suggesting certain savings goals or pots, tailored to youth would also build the relationship between the bank and young person.

4. Sharing information and educating youth on new features as they reach life stage where they become available to them.

Recommendation #3

Deliver relevant learning in the app and know when to deliver it

1. Youth don't want to go back to school and take exams for personal finance. Offering bitesize tips and tricks can make understanding key topics more palatable.

2. Key topics are not geared towards lending products, but rather PFM, using bank features or understanding how to navigate adult life

3. Interactive content is more desirable than read only - for example quizzes or videos.

Recommendation #4

Allow youth to partition their money

1. Enabling savings pots for youth TSB can easily show how to use PFM tools to budget and better control their funds.

2. Providing an income splitter feature or a guidance on the 50:30:20 budgeting rule at the point of payment would also encourage better control over finances.

Recommendation #5

Build positive financial habits by linking rewards to saving or spending trends

1. Small financial incentives that recognise positive habits would encourage young people to be more consistent with savings - which is a key behaviour that youth want to build.

2. Building positive saving habits can build a relationship with their bank. Especially as there is a general feeling that the bank has a role to play is building good habits.

Outputs

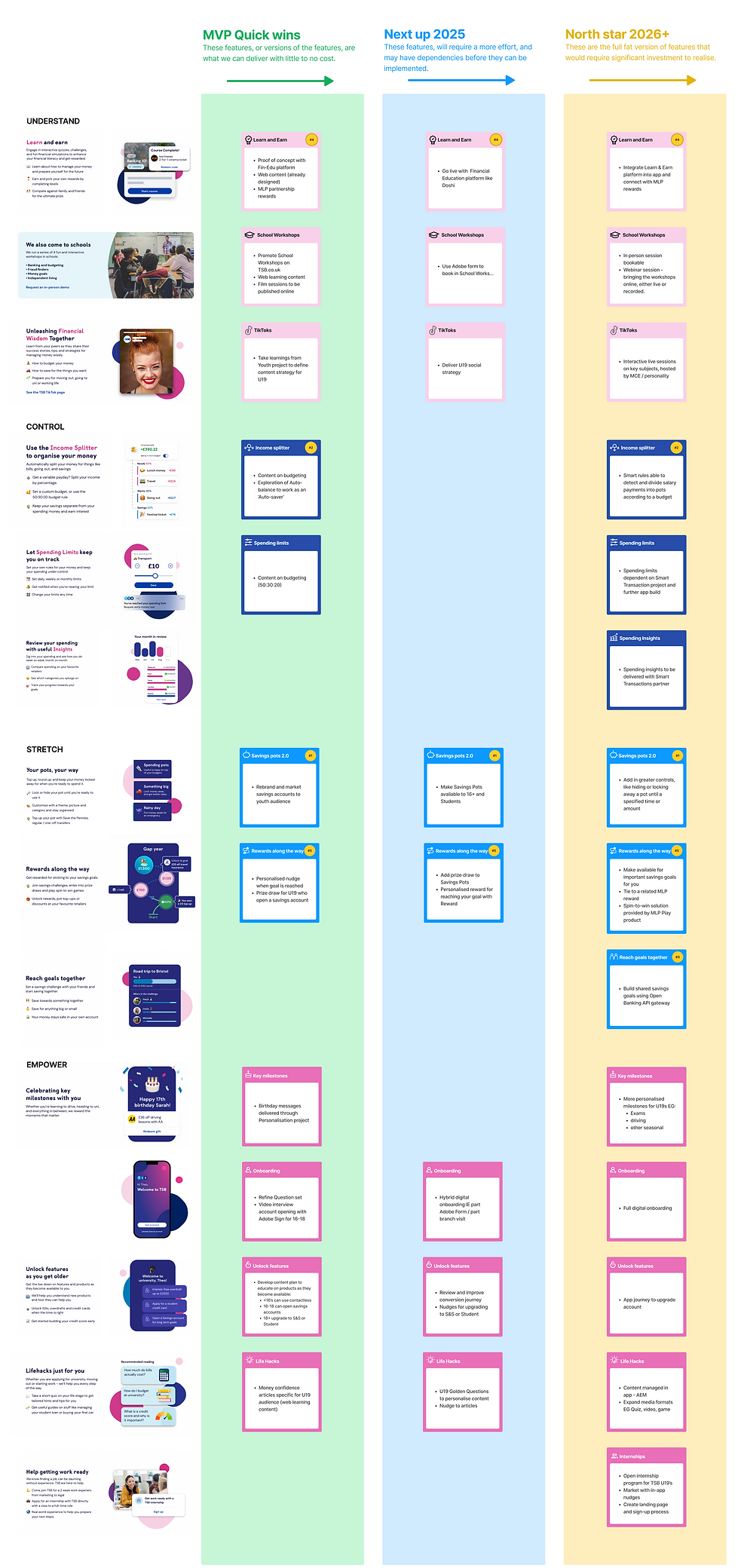

When thinking about outputs, we decided to break them down into quick win short term goals, mid term and long term.

Take aways

A few things I learnt on this youth banking journey.

Don't forget about 11-15 year olds and their parents

Most youth have a bank account by age 17, for many it is much younger. Parents are the biggest factor when deciding where to open an account, typically opting for the easiest choice - often their own bank. Invest in capturing customers young, as their have potential to being big earners in the future!

Young customers tend to stick around, keep them engaged

Youth typically retain their initial bank account into adulthood, only considering alternatives when their current account on longer provides the desired features or functionality.

Know your strengths

Banks should stick to money advice, youth will get the other advice elsewhere. We don't have to be everything to everyone, but they do expect us to be experts about money.

Aim for the stars, but getting to the moon is ok for now

Explore MVP designs that work towards our north star, creating a slice of the ultimate youth banking experience. Ultimately if we had a bigger budget we'd do more faster, but when money is tight it is useful to think about have you can solution issues and fulfil needs in stages.